16 of Interest rate. The tax ability of PF can only be considered in case of withdrawal from the fund other wise in cases whatever the amount contributed by the employer more is not at all taxable to the employee.

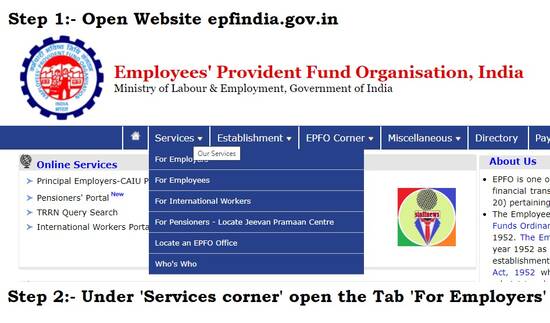

Review Of Confirmation Of Payment Of Epf Contribution By Contractors In R O Of Outsourcing Staff Staffnews

Rebate us 80C is available Employers contribution.

. For EPF i-Saraan contribution from the year 2018 until the year 2022. Thank you so much. To get a detailed breakup you need to get your hand on a copy of the PF statement where you will find information of both employee and employer contributions and other details including interest earned during the year in a.

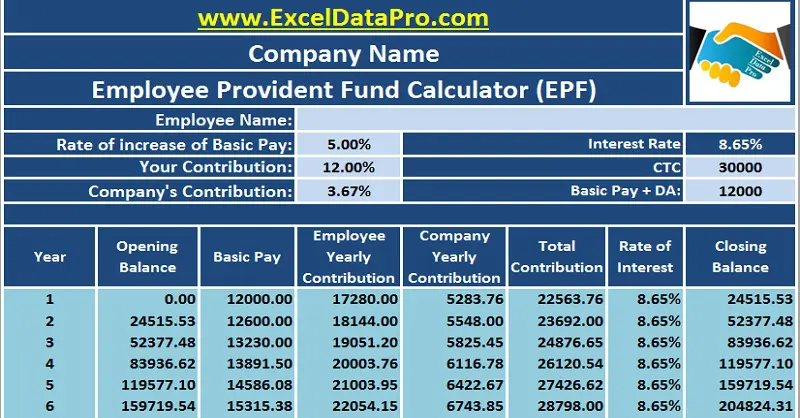

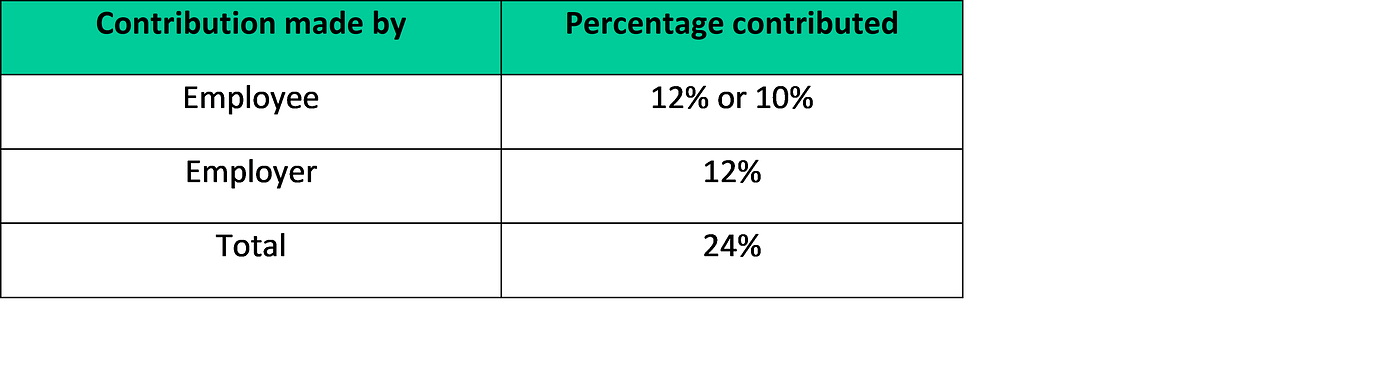

As per this Para for provident fund contribution on higher. Total EPF contribution every month 1800 550 2350. 1-10 circular dated 23-3-2017.

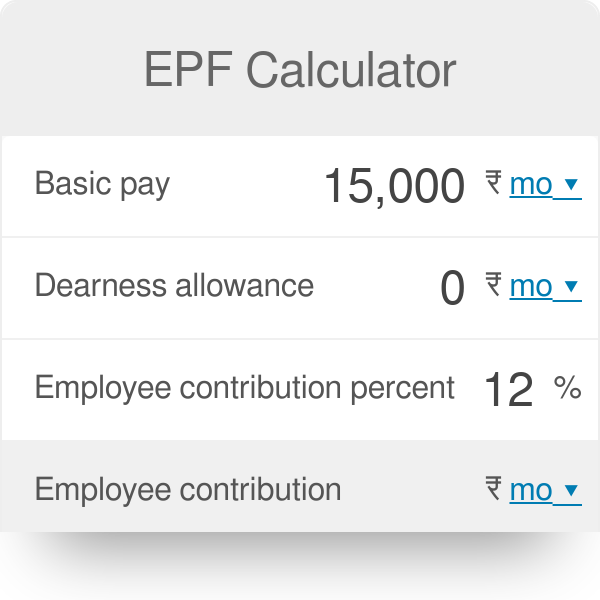

Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. As mentioned earlier. The applicable interest rate on EPF contribution for the financial year 2021-22 is 810.

Earlier in the year 2016-17 and 2018-19 the EPFO had given an 865 rate of interest to the subscribers. You are so helpful. Written by Rajeev Kumar Updated.

As of now the EPF interest rate is 850 FY 2019-20. 13 of salary Interest on PF. As an employee provident fund PF contribution is a part of your salary and you can see how much goes into it from your monthly salary slip.

As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. The EPF interest rate for FY 2018-2019 was 865. So lets use this for the example.

1995 on wages higher than the statutory wage limit is. It was 880 in 2015-16. August 4 2022 5.

Employees Provident Fund Interest Rate Calculation 2022. Theyll detect when receiving the EPF statutory contribution from the employer under statutory. But this rate is revised every year.

Hope the above helps. Under the EPF Scheme 1952. September 2 2020 at 711 pm.

Contribution on wages higher than the statutory wage limit is dealt under Para 266. Joint option of employee and employer tbr remitting contribution under EPS. What is the dividend rate for EPF Self Contribution.

Share And Stock Market Tips Epfo Signs Pact With Banks For Epf Contribution An Savings Account Financial News Changing Jobs

20 Kwsp 7 Contribution Rate Png Kwspblogs

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

Epf Contribution Reduced From 12 To 10 For Three Months

Ss Perfect Management Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Bi Jadual Ketiga 2020 Kwsp Pdf Facebook

Epf Interest Rate From 1952 And Epfo

Epf Cut In Employee Contribution Means Take Home Is High But Will Increase Tds Liability Here S All You Need To Know Business News Firstpost

Epf Interest Rate 2022 23 Notification Calculate Latest News

What Is The Epf Contribution Rate Table Wisdom Jobs India

The Central Board Of Trustees Of The Employees Provident Fund Organisation Epfo On 21st February 2019 Announced An Int Good News State Insurance How To Know

How Epf Employees Provident Fund Interest Is Calculated

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Epf Contribution Rates 1952 2009 Download Table

Epf Calculator Employees Provident Fund

Employee Provident Fund Epf The Complete Guide By Koppr Medium

How Does A Lower Epf Contribution Impact Your Retirement Savings

What Is Epf Deduction Percentage Quora